Sometimes, when running an online store, you make a sale but later receive a payment dispute notice. These usually happen weeks – or even months – after the initial transaction. Now you’ve got administrative work to take care of, the risk of losing the revenue from the sale, and less time to focus on running your business.

While this is usually an infrequent event, if it happens on a regular basis, important partners like credit card companies could start to levy fines, impose stricter rules, or cut ties with your business.

The good news is that a proactive plan to prevent disputes and manage them when they do occur will keep your store clear from headaches. Even better news? You can learn everything you need to know in this article.

Table of contents

- What are chargebacks or disputes?

- Why merchants need to respond to disputes

- What to do when you receive a payment dispute

- What happens if you don’t respond to chargebacks?

- What is a dispute threshold?

- How can I reduce my online store’s dispute rate?

- 1. Use a clear bank statement descriptor

- 2. Put company info on transaction receipts

- 3. Respond to customer complaints promptly and look for solutions

- 4. Initiate contact before fulfilling suspicious orders

- 5. Get proof of delivery

- 6. Clearly state policies

- 7. Use accurate product descriptions

- 8. Remove discontinued or out-of-stock items

- 9. Be cautious with international orders

- 10. Collect as much customer information as possible

- 11. Send shipment tracking information

- Strengthen your defenses against fraudulent charges

What are chargebacks or disputes?

A payment dispute happens anytime a cardholder contacts their credit card company to contest a charge on their bill. Credit card companies take these complaints seriously, and if they determine that the reason for the dispute is valid, they’ll provide a provisional credit to the customer’s account while the dispute is resolved. This is also known as a chargeback.

Why do chargebacks and disputes happen?

There are two primary causes of payment disputes:

- Dissatisfied customers

- Fraudulent card activity

We’ll dive deeper into both a bit later.

At first glance, you would think you’d have much more control over the first one than the second. The truth is, you have some control over both, as you’re about to see.

Why merchants need to respond to disputes

Payment disputes aren’t something you can just ignore and hope they go away. They won’t. Ignoring them will just cause problems to escalate that can impact the long-term viability of your store.

Card networks track your dispute rate (the ratio of confirmed transactions to disputed ones) and may charge higher fees or issue penalties if yours is unfavorable.

What to do when you receive a payment dispute

Here’s what to do when you receive a payment dispute notice:

Respond immediately

If the card network begins with an inquiry, you should respond immediately. If you use WooCommerce Payments, you’ll be notified of any disputes via email and an inbox notification in your dashboard.

A lack of response within a fairly short amount of time leads them to presume you’re not planning to contest the dispute. Each card network has their own timeframe for how long a dispute inquiry remains open, but you’ll want to carefully gather evidence while submitting said evidence before the timeframe expires.

If you’re using WooCommerce Payments, you can easily log into your store’s dashboard to respond to the dispute.

Provide documentation

Next, provide clear and compelling evidence about the transaction in question. This should include the credit card number (or the truncated version), the date and amount of the transaction, and any order details or proof of delivery you have on file.

This information allows them to rule out the possibility of fraud, and ensures that everyone has the same understanding of the situation.

Submit requested evidence

In addition to the basic documentation, the card network may ask for additional information regarding the transaction. And even if they don’t, you should send it anyway. Taking the time to gather all of the requested documentation is time well spent, but make sure you’ve gathered and submitted everything before the deadline.

The type of evidence you send will depend on the type of payment dispute you’re facing. There are at least seven types of payment disputes:

- Refund wasn’t processed

- Multiple charges

- Fraudulent charges

- Unrecognized charges

- Product not received

- Product unacceptable

- Subscription canceled

As you can see, the evidence required to contest each of these will be different. See this article for details on the type of evidence you’ll need in each of these situations. Regardless of the situation, we strongly recommend that merchants respond to each dispute with as much information about the transaction as possible.

What happens if you don’t respond to chargebacks?

Chargebacks might seem intimidating or difficult to deal with. However, it’s an important part of running a store and following some simple steps can save you a lot of stress. Credit card companies still want you to be successful while protecting their users, so work within the process to maintain a solid reputation.

If you choose to totally ignore chargebacks, however, things can become difficult. Here’s the progression of ignored or unchecked chargebacks:

First, you lose the profit and the revenue from the sale and have to pay a fee on top of that loss.

After that, if your disputes start to accumulate and you don’t keep them under control, your card network could levy more fines and higher fees until you bring your chargeback rate down. If the problem persists, you might be restricted from accessing portions of your sales revenue. Finally, they can eventually cease allowing you to accept payments, and mark your account as high risk.

This could keep other card networks from wanting to do business with you. And if you can’t accept payments online, you can’t really run your business.

This, of course, is an extreme case. It’s totally preventable if you take the right steps.

What is a dispute threshold?

The dispute threshold, or chargeback threshold, is what card networks use to help them decide when to increase monitoring and penalties on a merchant or business to get them to reduce their dispute rate.

What’s a dispute rate?

The ‘dispute rate’ measures the number of disputes per total processed transactions in a given time period, such as one week. So, if you had 500 payments processed in a week and five of those got disputed, you would have a 1% dispute rate for that week.

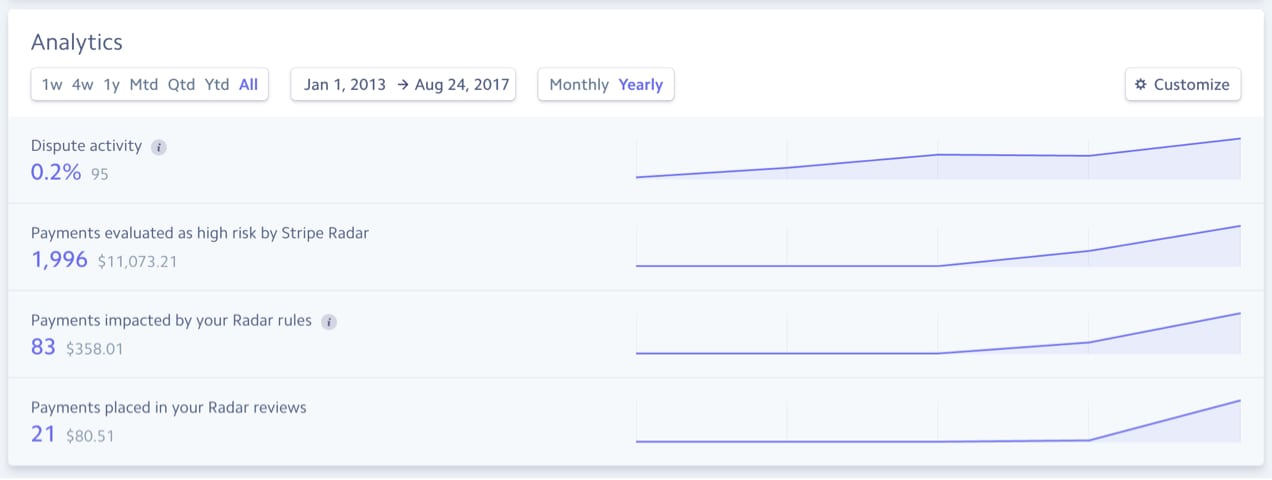

This is distinct from ‘dispute activity,’ which measures the percent of disputes in a given time period, regardless of processing date.

The difference is that some disputes don’t happen until weeks or months after the purchase. This is what dispute activity incorporates. You might get five disputes in one week, but if three of those relate to purchases made prior to that week, then your dispute rate would only include the two from that week, but your dispute activity would include all five. Here is more from Stripe on measuring disputes.

Credit card networks typically use dispute activity for their dispute thresholds. And again, each card network has its own threshold. The threshold could be based on dispute activity, dispute volume, or more commonly, both.

For instance, Visa will increase their penalties against a business with at least 100 chargebacks in a month and 0.9% dispute activity. But Mastercard’s dispute threshold begins at 1.5%.

The volume number is helpful for small businesses, because if you only receive 50 payments in a given month, and just one of them gets disputed, you’re already at a 2% rate. So the volume threshold keeps smaller businesses away from the higher penalties.

If you’re using WooCommerce Payments and have questions about how to best handle disputes, you can always reach out to the WooCommerce support team for assistance.

How can I reduce my online store’s dispute rate?

Now that you understand how disputes work, here are some strategies to help reduce your dispute rate.

You can learn more about some of these here.

1. Use a clear bank statement descriptor

This is the short phrase that appears on credit card statements for each purchase. Ideally, it should say your company’s name, state/region/province, and perhaps even include a phone number. Descriptors are limited to a maximum of 22 characters, so you’ll have to be creative and carefully choose what will be most recognizable to your customers. Why?

A clear statement descriptor informs your buyers of where they purchased an item. It could immediately reduce disputes caused by unrecognized charges. They’ll see your information and remember that, yes, it’s a legitimate purchase they intended to make.

And if a customer sees this on their statement and wonders about the charge, they may call you directly rather than file a dispute with their credit card company, and you can resolve it with them.

2. Put company info on transaction receipts

For the same reason as the bank descriptor, giving the customer easy-to-read, accurate company information on their receipt increases the chance that they’ll call you if there’s a problem, rather than their credit card company.

Include your company name, location, contact information, website, logo, and a message about customer service. And be sure this doesn’t interfere with the transaction details on the receipt.

3. Respond to customer complaints promptly and look for solutions

Remember, there are at least seven causes of chargebacks. Several can be resolved before reaching the dispute stage simply by providing good customer service.

If a customer complains about a product, its quality, damage during delivery, or other aspects, listen to them and work with them to solve the problem and avoid a chargeback.

4. Initiate contact before fulfilling suspicious orders

This is one of your best tools to use against fraud. As a savvy business owner, it’s important to review your orders for any indication of fraud or risk.

WooCommerce Payments includes a risk level column on your dashboard. It grades every transaction for fraud risk. If you see a transaction with any label other than ‘normal,’ don’t fulfill the order before calling the cardholder to see if they really made this purchase.

If you receive no response, especially with repeated attempts, or if the phone number appears to be invalid, consider refunding the order without shipping it.

Most other payment processors offer some sort of fraud detection metric, but they’re not always as easy to use. With WooCommerce Payments, it’s right there next to each transaction. There’s no need to sit on hold with your credit card company for half the day.

5. Get proof of delivery

Whenever possible, this is a solid piece of evidence you can use in cases where a customer claims the order never arrived. Examples include, shipment tracking details, requiring a signature upon delivery, taking a photo of the final delivered item, etc…

6. Clearly state policies

Your policies about refunds, returns, and cancellations matter to your customers. Put these on your invoices or receipts. Feature them on key website pages, such as your checkout page. Include them on store displays. It’s even better if you can get the cardholder to sign or acknowledge that they agree to your terms.

7. Use accurate product descriptions

Product descriptions need to match the product. When a cardholder receives something that seems different from what they thought they ordered, they may contest the charge because they’ll assume you sent them the wrong product.

Details matter. Don’t skimp.

8. Remove discontinued or out-of-stock items

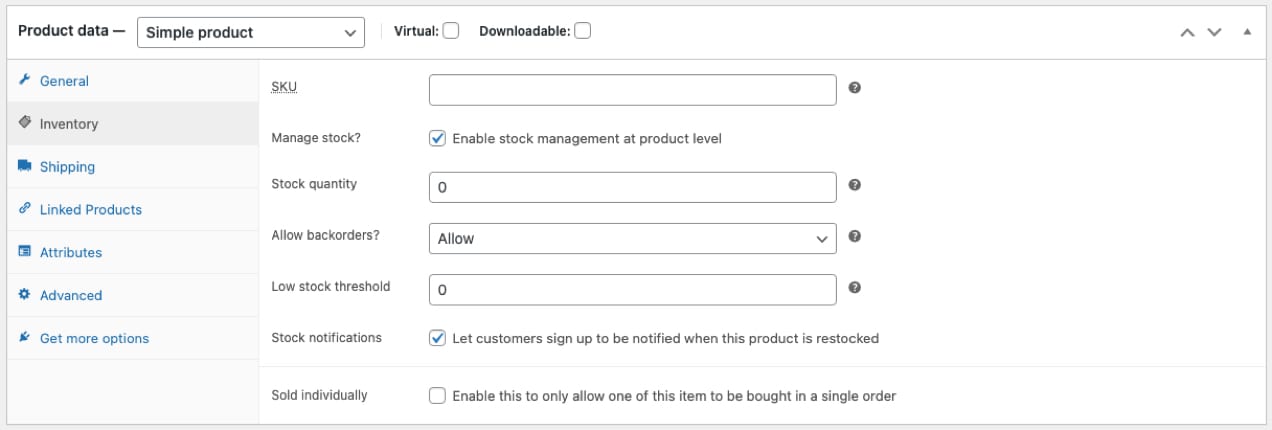

Remove items from your online store that are no longer available so customers can’t order something they won’t receive. You might consider doing the same for items out of stock, unless you can easily and accurately include an ‘out of stock’ graphic on the relevant product pages, and keep up with it as the status changes.

This is done automatically if you take advantage of the built-in inventory management on WooCommerce. You can choose to allow backorders or stop sales of out of stock items. Most merchants will want to toggle settings to, “Do not allow,” or “Allow, but notify customer.”

9. Be cautious with international orders

Certain types of fraud are an unfortunate reality in this day and age, and orders from some regions may pose a higher risk. It helps to choose a payment solution that includes fraud detection to help mitigate this risk, such as WooCommerce Payments.

10. Collect as much customer information as possible

Not every business needs to collect shipping information, but get it anyway. This helps verify that a cardholder is who they claim to be.

For every transaction, you want the following information:

- Customer name

- Customer email

- CVC number on their credit card

- Full billing address and postcode

- Shipping address, if different from billing

11. Send shipment tracking information

Be prompt with this. After a customer orders, they should receive an email with tracking information as soon as possible. After that, they should get periodic updates. This serves as more evidence if a customer claims the product never arrived.

Strengthen your defenses against fraudulent charges

Want to improve your fraud risk detection? That’s just one benefit of using WooCommerce Payments, which helps online businesses accept payments, preserve their reputation, and maximize profits.

Original article written by Shubert Koong >